Like any business, financial advisers these days rely heavily on the use of software. There is a wide selection of tools available to allow advisers to streamline their operations, but that means choosing the right solution can be difficult.

There are, of course, also considerations surrounding compliance and the security of client data in order to comply with legislation like GDPR and MIFID II – https://www.fca.org.uk/markets/mifid-ii. This means that systems must be chosen carefully and steps taken to ensure that they are properly configured – especially if information is stored in the cloud.

Selecting software

It’s tempting when setting up a new advisory business to want to do everything at once. But for most companies it’s better to start small. Sort the essentials out first and then add the more ‘nice to have’ elements later on.

A lot of software companies now offer trial periods of 30-days or so. Take advantage of these to try out some different solutions and see if they are a good fit for your operation. Important factors to take into account is how easy solutions are to use and how well they integrate with any existing systems that you intend to retain.

Start with a shopping list of features that are most essential to your business and use this to select a shortlist of packages that suit your needs. And, of course, don’t neglect the cost of the software.

Vital tools

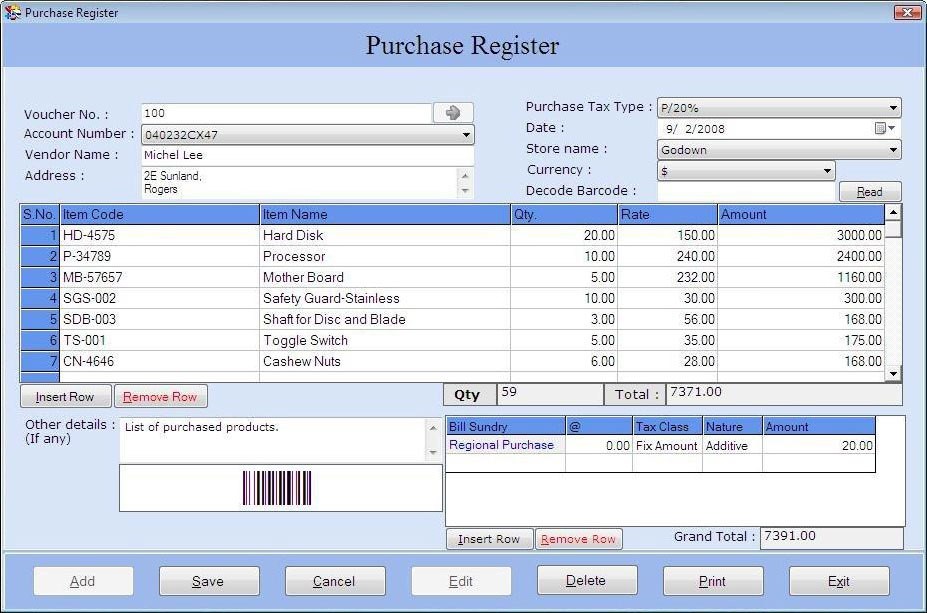

For an independent financial advisor Swindon offers plenty of clients and companies like https://chilvester.co.uk/ need to be able to manage them effectively. This means one of the key tools they need is customer relationship management. A CRM system also needs to work with your financial management, billing and account notification systems in order to deliver a streamlined back office solution. It’s also vital to ensure that any system can cope with a move towards paperless transactions, using eSignatures on documents, for example.

Financial planning software is another essential for advisers. This is useful because it not only helps the adviser’s workload it can help to deliver a better client experience. There are now a number of-all-in-one systems aimed at financial advisers and these can be an attractive option for start-up businesses, giving them the flexibility to add additional capabilities and modules as their business expands.